MICROOLED, the leading manufacturer of high resolution, low power consumption OLED microdisplays, announces a €21 million fundraising led Jolt Capital, a specialist in private equity for responsible deeptech companies, with the French sovereign wealth fund Bpifrance via its Innovation Defense vehicle, alongside both historical investors, Cipio Partners and Ventech.

Smartphones and tablet PCs can be used as gateways to augmented reality, but smart glasses will soon become the dominant wearable equipment to do so. They will require the use of embedded microdisplays that can offer high luminance and contrast, but also very low power consumption from super lightweight batteries. Among competing technologies, organic LED (OLED) demonstrate an excellent overall performance compared to classic LED ones, and they are increasingly used for see-through Near-Eye Displays (NED) in viewfinder eyepieces for cameras.

Recent announcements for new mixed-reality headsets that could reach the shelves in 2024 have boosted the AR market, including applications for industry and security segments. The global market for microdisplays designed for AR/VR use could reach $4 billion by 2027, according to a 2022 report by KBV Research, a 4x increase compared to 2020, with 10% of the total value captured by OLED technologies. 15 million units of AR smart glasses could be shipped worldwide by 2027, according to CCS Insight.

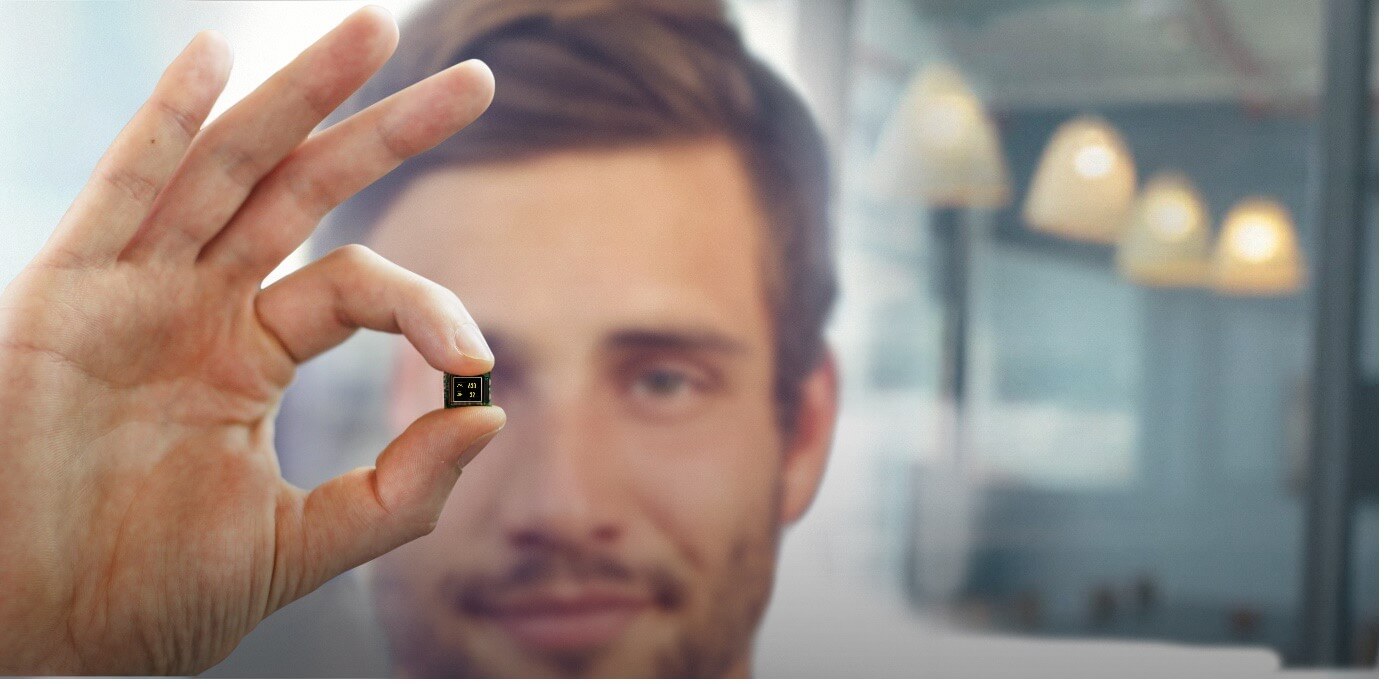

Among the handful of international players able to design and manufacture these low energy consumption OLED microdisplays, MICROOLED can address both consumer and recreational markets (the ActiveLook head up display module to be embedded in glasses for real time visual information in hand free activity use cases), and industry/security ones. Since 2007, the Grenoble-based company has developed a wide range of core technologies derived from the semiconductor industry, protected by over 170 granted patents, through a close collaboration with neighbor CEA/Leti research centers. MICROOLED is perfectly positioned to grab leadership in the field of wearable ultra-lightweight HUDs. To cater to the various needs for “light AR” applications, the company offers a line-up of compact products ranging from 0.2” to 0.6” in size, with high resolution and power as low as 1mW.

MICROOLED’s €21 million financing round, led by Jolt Capital and the Innovation Defense Fund managed by Bpifrance and underwritten by the French Defense Innovation Agency to support the scaling of dual-use technologies, will allow MICROOLED to finance the development of the next range of full colour, high luminance OLED solutions, to expand manufacturing capabilities in Grenoble, and to grow international sales teams in the security segment and the B2B ActiveLook platform model. Both historical shareholders, Cipio Partners and Ventech, also reinvested in that new round.

Quotes

“We are very pleased with Jolt Capital and Bpifrance joining our cap table, and to see that our historical shareholders Cipio Partners and Ventech continue their support. All of them understand deeptech and the stakes of sovereignty. Innovation is at the heart of our strategy, and this new funding will allow us to double down on our efforts to bring to market the most disruptive technologies in the field of AR.” says Eric Marcellin-Dibon, CEO of MICROOLED.

“MICROOLED is the archetypal growth deeptech company that we are looking for at Jolt. Patented core technologies in the field of semicon, a genuine potential to build manufacturing capacity in Europe, a series of fast growing B2B markets, and powerful but energy frugal products. We are delighted to have them join our portfolio and are looking forward to helping them scale to global leadership in light AR.” comments Pierre Garnier, Managing Partner at Jolt Capital.

“We are delighted to become a shareholder of MICROOLED, to help them reach another level in terms of technology development, sales, and industrial capacity. MICROOLED is a key global supplier of the near-eye microdisplays market, for both military and civilian applications. It perfectly matches the strategy of the Defense Innovation Fund, aiming at supporting the growth of tomorrow’s deeptech champions.” adds Nicolas Berdou, investment director at Bpifrance.

Boiler plates

About MICROOLED | https://microoled.net

With €25 million invested in research and development since its creation in 2007 in Grenoble’s Tech Valley, MICROOLED specializes in the design, production and marketing of OLED microdisplays for near-eye applications (outdoor optical equipment, night vision glasses, ocular equipment for medical devices, augmented reality glasses, etc.). In just a few years, MICROOLED has become a key partner of the world’s top technology integrators with a unique technology that combines high resolution, high levels of brightness and low energy consumption. Thanks to its solid stand-out technological expertise, MICROOLED is the leading player in Europe and number two worldwide in its historical markets. The company is now looking to conquering the SporTech market with the roll-out of ActiveLook(R), its disruptive solution for augmented reality glasses designed for sports enthusiasts around the world.

About Jolt Capital | www.jolt-capital.com

Jolt Capital is an independent private equity firm specialized in growth investing in advanced technology companies, with a mission to build future European leaders with a global focus. Since 2011, Jolt Capital invests in European B2B companies with revenues between €10M and €50M. Jolt Capital’s team is composed solely of experienced investors and managers of high-tech companies. Its proprietary AI platform, Jolt.Ninja, enables enriched sourcing, accelerated due diligence and automatic detection of investment or acquisition targets. Jolt Capital is located in Paris, Lausanne, Copenhagen, and Milan.

About the Defense Innovation Fund and Bpifrance | www.bpifrance.fr

Launched in 2020 by French Ministry of Armed Forces, on the initiative of the French Defense Innovation Agency, the Defense Innovation Fund supports with equity and quasi-equity the growth and development of innovative companies with dual-use technologies that play a specific role in the defense sector. The Fund size is €200M. The goal is to hatch new players with critical mass at French and European levels.

Bpifrance Investissement is the management company that handles Bpifrance’s equity investments. Bpifrance is the French national investment bank: it finances businesses – at every stage of their development – through loans, guarantees, equity investments and export insurances. Bpifrance also provides extra financial services (training, consultancy) to help entrepreneurs meet their challenges (innovation, export…). Thanks to Bpifrance and its 50 regional offices, French entrepreneurs can benefit from a unique and efficient community advisor.

Twitter : @Bpifrance / @BpifrancePresse

About Cipio Partners | www.cipiopartners.com

Founded in 2003, Cipio Partners is a leading investment management and advisory firm for European growth capital & minority buyouts for technology companies. Cipio Partners targets European growth stage technology businesses with €10-50 million in revenue and makes initial investments ranging from €5-15 million. Cipio Partners operates from offices in Munich and Luxembourg.

About Ventech | www.ventechvc.com

Ventech is a global early-stage venture capital firm with a strong digital focus. Founded in 1998, Ventech backs the most innovative and visionary tech entrepreneurs with a global ambition. With its dual structure platform, Ventech has dedicated funds for Europe (Paris, Munich, Berlin & Helsinki) and Asia (Shanghai and Hong Kong). Since its inception, Ventech has raised over 900m€, and has realized over 200 investments, (including Vestiaire Collective, Passion.io, Ogury, Picanova, Veo, Reveal, Speexx) and over 90 exits (Fintecsystems – acquired by Tink; Believe (BLV.PA) – listed on Euronext; Arteris (AIP) listed on Nasdaq). LinkedIn and Twitter: @Ventech_VC